News alert: Beazley reports on how AI, new tech distract businesses as cyber risk intensifies

The Last Watchdog

JULY 13, 2023

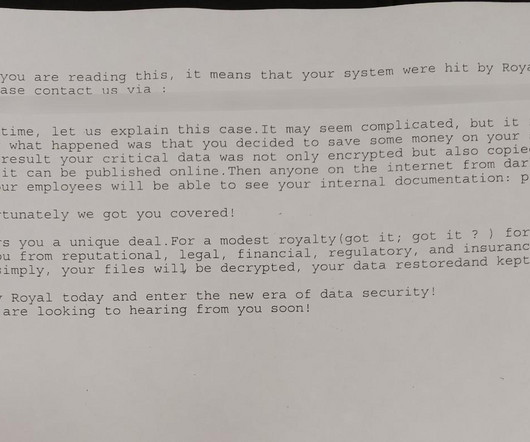

London, July 13, 2023 — Beazley, the leading specialist insurer, today published its latest Risk & Resilience report: Spotlight on: Cyber & Technology Risks 2023. Yet, boardroom focus on cyber risk appears to be diminishing. trillion by 2025, a 300% increase since 2015 1.

Let's personalize your content