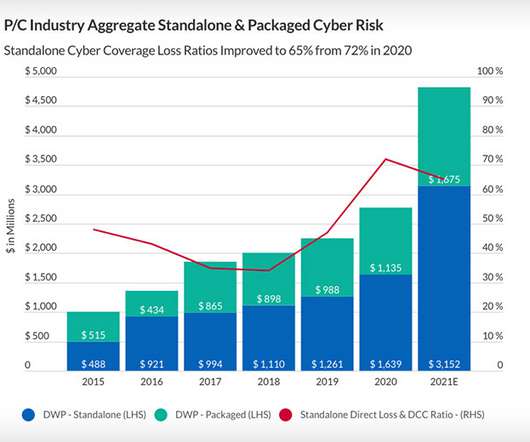

Premium Hikes Spur Improved US Cyber Insurance Loss Ratios

Data Breach Today

APRIL 15, 2022

Declining Loss Ratios Means Insurance Premium Increases Might Moderate in Late 2022 A surprising improvement in loss ratios for cyber insurance providers in 2021 means the rapid rise in premiums might at last subside later this year.

Let's personalize your content