France: Changes to insurability of cyber losses

DLA Piper Privacy Matters

MARCH 27, 2023

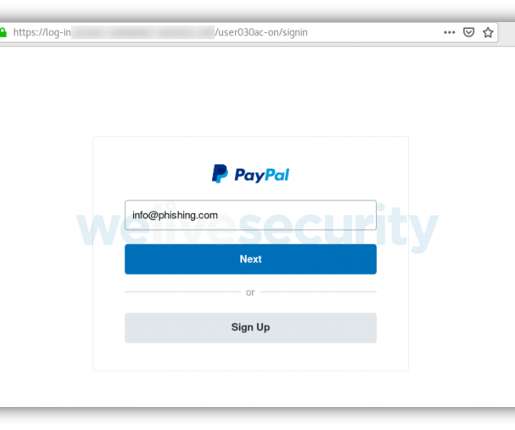

LOPMI introduces amendments to the insurability of losses and damages paid in response to cyber-attacks, including in relation to ransom payments – requiring that the payment of insurance compensation be conditional on the filing of a complaint, within a 72 hour time frame, to competent authorities.

Let's personalize your content