Insurance and Ransomware

Schneier on Security

JULY 1, 2021

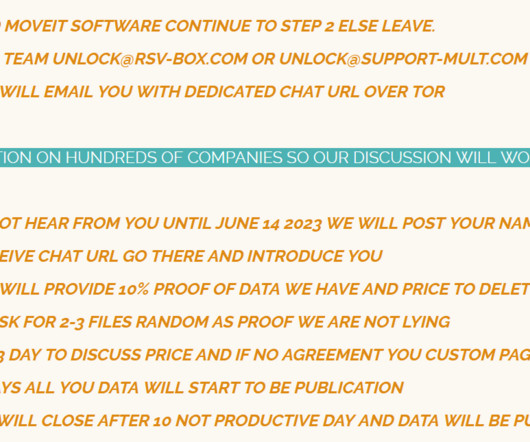

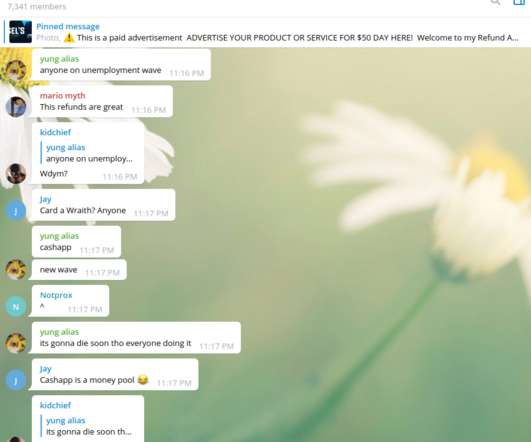

Here’s one more contribution to that issue: a research paper that the insurance industry is hurting more than it’s helping. Although it is a societal problem, cyber insurers have received considerable criticism for facilitating ransom payments to cybercriminals. Often, that’s paying the ransom. News article.

Let's personalize your content