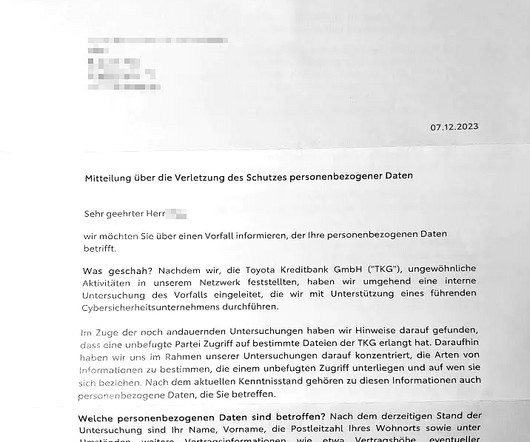

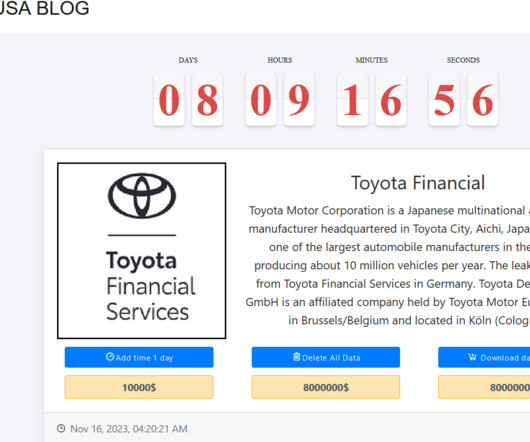

Toyota Financial Services discloses a data breach

Security Affairs

DECEMBER 11, 2023

Toyota Financial Services (TFS) disclosed a data breach, threat actors had access to sensitive personal and financial data. Toyota Financial Services (TFS) is warning customers it has suffered a data breach that exposed sensitive personal and financial data.

Let's personalize your content