Cybersecurity Insurance: Has It's Time Come?

Data Breach Today

JUNE 15, 2021

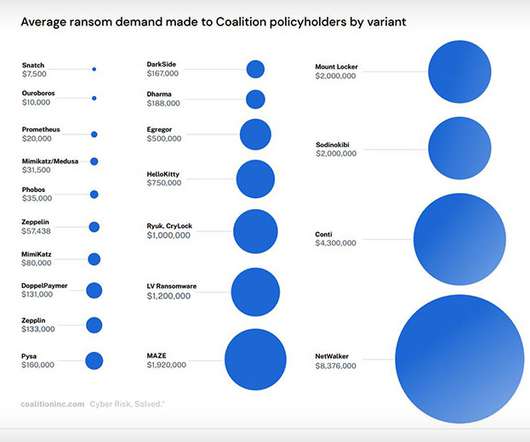

As the cyberthreat landscape grows exponentially more complicated, the insurance industry is trying to keep pace. Yet, many organizations still lack cybersecurity insurance. Lynn Peachey, director of business development at Arete Incident Response, breaks down the basics of these insurance policies.

Let's personalize your content