Report: Big U.S. Banks Are Stiffing Account Takeover Victims

Krebs on Security

OCTOBER 7, 2022

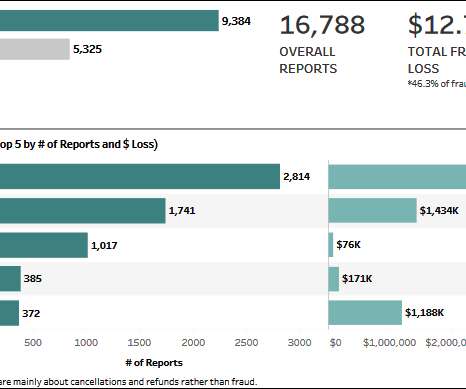

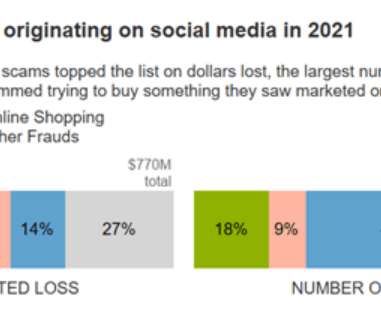

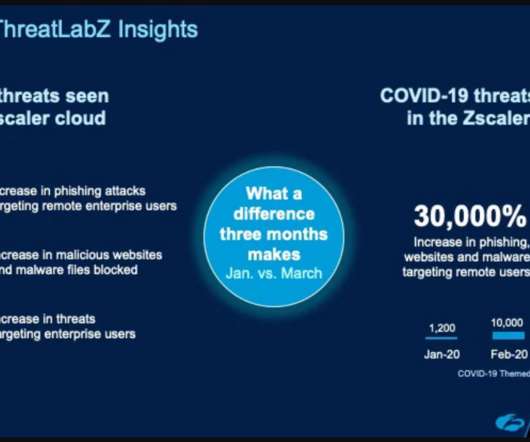

consumers have their online bank accounts hijacked and plundered by hackers, U.S. A common example of the latter is the Zelle Fraud Scam , which uses an ever-shifting set of come-ons to trick people into transferring money to fraudsters. “That’s money that they’re paying for out of pocket almost entirely for goodwill.

Let's personalize your content