How to Eliminate Paper Processes

AIIM

AUGUST 19, 2021

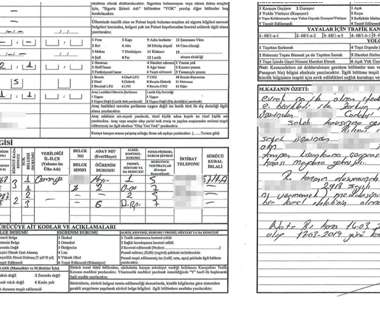

Despite the proven operational improvements to be gain by going paperless, paper is still prevalent in too many core business processes today including loan applications, insurance claims, and customer onboarding. Steps to Eliminate Paper. What are the Benefits of Eliminating Paper Processes?

Let's personalize your content