By Petra Beck, Senior Analyst Capture Software

We are often faced with questions like: How do we justify an investment in a Capture or Intelligent Document Processing (IDP) solution? What priority should an IDP project take compared to other digitalisation projects? Is there a tangible business impact from a top-line or bottom-line perspective?

THE ROLE OF IDP IN THE AUTOMATION OF INPUT MANAGEMENT

Before we discuss the role of IDP, we need to look at the scope of the term. Infosource defines this market segment as software offerings that understand and extract meaningful, accurate, and usable information. They acquire, classify, and convert unstructured and semi-structured information into enhanced usable data for use in business transactions, analytics, records management, discovery, and compliance applications.

The bottle necks in the automation of a mission critical business process often lie in the ingestion of business inputs from end customers or partners. These inputs arrive through different channels in different formats, a significant portion often as paper documents. The ingestion of these inputs into the respective processes frequently involves a significant effort to identify the inputs, associate them with the respective business transactions, extract the data elements required, check them against core systems etc.

The strength – or in this case the automation level – of a business process is only as strong as its weakest element. Therefore, the ingestion of business inputs may account for a small element of a complex business transaction, but it has a significant impact on its automation. The deployment of an IDP solution and its capabilities to seamlessly ingest all omnichannel inputs and automate validation and augmentation of data elements has a key impact on the experience of customers involved in this transaction.

THE IMPACT OF CUSTOMER EXPERIENCE ON BUSINESS GROWTH

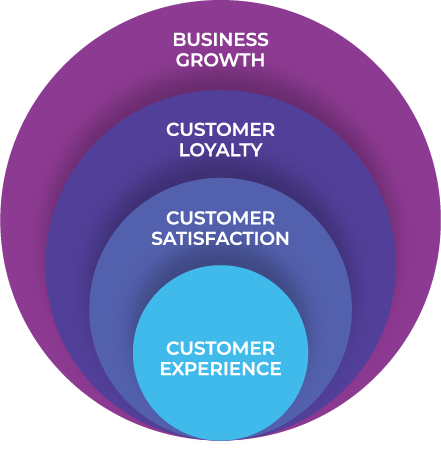

Why is customer experience such a critical aspect for organisations? It has a direct impact on the top line, i.e., the revenue and business growth as well as the bottom line i.e., the profitability.

For example, if your experience as an end customer in an interaction with your bank, insurance carrier, car dealer etc. is negative, your satisfaction with this organisation is going to suffer. Hence, the next time you make another purchase, look for an insurance policy, or a banking service, you will likely look for alternatives to the organisation where you had an unpleasant experience.

The experience during this initial interaction with the new employer, a new supplier etc., accounts for a significant element of factors that influence the future engagement of a new employee, the satisfaction with a new supplier and ultimately, loyalty.

Let’s illustrate the role an IDP solution can play in ensuring a positive customer experience by examining the different stages of a Customer Onboarding process, using the example of a loan application.

It starts with the prospect, who has researched alternatives based on her/his specific needs selecting a financial services provider and type of loan and submitting a request.

The financial services institute requests a proof of identity and documentation to ensure that the person qualifies e.g., proof of residence, income etc.

The next step, or likely several steps relate to Anti-Money Laundering, Fraud, and Risk assessment.

Once all required inputs have been received, and the assessments have not identified any concerns, the decision is made to grant a loan to the existing or new customer. Core system entries are then made etc.

All these process steps used to be done completely manually, but Intelligent Capture and IDP solutions coupled with process automation technology for the validation and communication steps can automate the process end-to-end.

Reduce onboarding journey time

Increase the transparency of the process

Meet confidentiality and data security requirements

Immediately focus on new customer / employee / patient / student etc.

All Onboarding use cases are characterised by similar customer requirements. They directly translate into the requirements for an IDP solution and their opportunity to impact Customer Experience.

- The most important aspect is the time involved in the process, from the first request to the final decision and communication back to the end customer. For the new customer, applicant, patient etc., this has a significant impact on their experience. For the organisation, it means that the onboarding process needs to be streamlined and shortened. This translates into reduced manual process steps, reduced time spent by knowledge workers, and of course, reduced costs.

- A related aspect is the transparency of the process, especially from an end customer perspective. Even if the request or application is processed quickly and smoothly, the lack of status update can result in a negative experience for the end customer.

- Another important aspect and a concern for both, the applicant and the provider are confidentiality and data security. Many use case versions involve documents that contain personally identifiable information (PII).

- The ultimate end goal is to focus on the new customer, client, student, patient etc., as quickly as possible. An IDP solution can play a significant role in supporting this objective and ensuring a positive customer experience throughout the process.

INFOSOURCE CAPTURE SOFTWARE DIVISION

Infosource is a leading global analyst firm headquartered in Geneva, Switzerland. In December 2019, Infosource acquired HSA, Inc., an analyst firm founded in 1989 that specialised in Capture Software, which now serves as foundation for Infosource’s Software Division.

Infosource Software is the leading authority on Capture and Intelligent Document Processing systems and provides analysis and guidance on the Capture and IDP software market. The scope of Infosource’s analysis covers software and solutions for the ingestion of unstructured and semi-structured business inputs with the objective of automating business processes.

Our software analyst team conducts in-depth analysis of the business use cases as well as other metrics that are critical to analyse the changing market requirements of end customers in the respective vertical markets.