The long awaited International Financial Reporting Standard (IFRS-17) is finally upon us – coming into effect on January 1, 2023. Its impact is far reaching and global, requiring insurance companies of all types and sizes, bancassurance and any entity that sells insurance products to comply with stringent IFRS-17 rules and comprehensive reporting guidelines.

Recently I had the opportunity to meet with Mandar Mahajan, one of the Domain Experts on IFRS-17 at Collibra, to get his perspective on the significance of this standard, some of the implementation challenges faced by insurers and how Collibra Data Intelligence Cloud can help accelerate IFRS-17 compliance. Following are a few highlights from our conversation.

Why is IFRS-17 important?

IFRS-17 is one of the most consequential accounting standards enacted in decades for the recognition, measurement, presentation and disclosure of insurance contracts. It will encompass risk management, actuarial valuation, asset liability management and financial reporting practices. Insurers will have to measure liabilities, accurately calculate risks and report on revenue recognition, including unearned profits. It aims to eliminate inconsistencies, opacity and weaknesses in the current system by standardizing insurance accountability globally while increasing consistency, comparability and transparency surrounding an insurer’s financial position, performance and risk exposure.

What are some of the requirements and challenges associated with implementing IFRS-17?

Given its broad mandate, IFRS-17 will have a significant impact on underlying systems, business processes and data. For instance, insurers will have to overcome data silos and aggregate massive volumes of data from across disparate data sources for risk calculation, back-testing, analysis and reporting purposes. They will need to enact a comprehensive data management and governance strategy in order to achieve adherence to IFRS-17 guidelines and provide detailed audit trails.

This will require an intelligent data platform with a holistic and integrated approach to cataloging, governing, protecting, managing and collaborating on data. A common foundation for data will enable insurers to mitigate operational risks and leverage trustworthy data throughout the process.

How can Collibra Data Intelligence Cloud help accelerate IFRS-17 compliance?

At Collibra, we work with many of the leading insurance companies, retail and investment banks as well as diversified financial institutions globally to help them derive value from their data and enable a plethora of strategic initiatives and use cases including regulatory compliance and reporting – from IFRS-17, Solvency II, BCBS 239 and CCAR to CCPA, GDPR, and more.

Our customers use Collibra Data Intelligence Cloud as a foundational platform to catalog, govern, protect and manage all their data at scale across on-premises and multi-cloud environments.

For instance, AXA XL is using Collibra Data Intelligence Cloud to improve data literacy and transparency. Using Collibra as their foundational data platform, they are democratizing the use of fully governed data throughout the enterprise. Another major property and casualty insurer is using Collibra Data Intelligence Cloud to enable regulatory compliance and reporting. With Collibra, they were able to complete a regular audit in just four weeks instead of what used to take them over one year.

With Collibra Data Intelligence Cloud, insurers can:

- Rapidly catalog all their data regardless of where it resides to create a single, trusted repository of metadata (data about data). The catalog offers advanced capabilities that are purpose-built to empower users to easily find and understand the data they need with rich business and technical context at a granular level. For instance, users can gain a better understanding of disclosures. They can seamlessly collaborate on data to validate and certify it for use. Moreover, they can leverage built-in crowdsourcing capabilities such as rate, comment on, and prioritize data sets, to provide feedback.

- Enact a comprehensive data governance strategy and develop a consistent data taxonomy that includes IFRS-17 specific rules, disclosures, data usage registry, physical and/or logical data dictionary and glossary of terms. With Collibra Governance, insurers can speed the automation of complex regulatory rules and guidelines such as those found in IFRS-17. Pre-built templates, out-of-the-box data domains and intuitive workflows provide a framework for cross-functional teams – such as Finance, Risk Management and Compliance – to establish a common understanding of data to ensure consistency.

- Address data quality and privacy issues at scale to ensure data integrity – right down to the portfolio and contract levels. For instance, Collibra predictive data quality and observability leverages machine learning (ML)-enabled capabilities to proactively detect anomalies in data such as missing records, values as well as broken relationships across tables or systems resulting in rapid resolution. Moreover, advanced capabilities in data protection will help ensure classified and sensitive financial data is easily identified and fully protected with role-based access control.

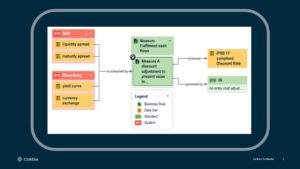

- Obtain visibility throughout the process with an active metadata graph and end-to-end data lineage, enabling users to easily visualize the flow of data from source to target as well as understand all the data dependencies at a granular level. For instance, users can better understand how risk models were computed or figures in financial disclosures were calculated and trace lineage of each data set with comprehensive audit trails for reporting purposes.

What is the level of IFRS-17 readiness across the industry?

Over the past five years, several insurers, especially the multinationals, have already begun their implementation process. However, we believe that an overwhelming number of companies are just starting to plan for IFRS-17. They are at risk of missing the fast-approaching deadline.

At Collibra, we have partnered with leading global system integrators that have deep expertise in IFRS-17. Moreover, given that regulatory compliance is a key use case for our customers, the built-in capabilities within Collibra Data Intelligence Cloud as well as best practices that we’ve developed can help insurers speed their implementation process.

Next Steps

To learn more, I would like to recommend the following webinars: Vanguard Evolves Data Governance to Drive Growth, and Moody’s: Data Lineage: Get the Full Story Behind Your Data

Mandar Mahaja is a Sales Engineer at Collibra who works closely with our insurance and financial services customers.

Maneeza Malik is an Industry Solutions Marketing Director at Collibra. She is responsible for driving industry solutions strategy and marketing efforts. Maneeza brings over 20 years of experience in the data, analytics and AI space with deep vertical expertise in several industries.