Geneva, Switzerland – August 26, 2022

WHAT IS GOING ON IN THE RUSSIAN MARKET?

-

- 1. ECONOMY IN GENERAL, IMPACT OF SANCTIONS

After several years of negative growth due to massive capital flight, the collapse of the ruble, and falling oil prices, the Russian economy returned in FY 2021 to substantial growth for the first time since 2017, driven mainly by natural resources extraction and private consumption. However, due to the Russian military invasion of Ukraine, and resulting economic sanctions, draining of foreign investments (but of course also because of other perennial problems plaguing the Russian economy), the market has been in fundamental confusion ever since, which will undoubtedly continue for some time.

Among the permanent factors affecting the Russian market are, for example, the unemployment rate, low real wages, and extreme social inequalities, which remain high both in large cities and rural areas. Only 1% of the population owns around 70% of private assets, worth hundreds of billions of dollars. Despite the emergence of an urban middle class, the poverty rate remains at around 13%. A middle-class protest movement calls for an end to corruption and patronage. However, these patterns are deeply embedded into the Russian system, and any attempts to change them will be unsuccessful in the near future.

Therefore, what is going on in the vast Russian market at present?

Western governments imposed a series of financial, trade, and travel sanctions on Russia in late February in response to Moscow’s invasion of Ukraine. With almost four months of observations and data, policymakers are now assessing the impact of the sanctions, weighing the risks of increasing pressure on Russia with new sanctions, and considering how the sanctions might contribute to an end to the war.

Many experts believe that perhaps stronger sanctions could have deterred Russia before the invasion (as the proverb says: it is easy to be wise after the event) but using sanctions to coerce Russia to end the war now seems very unlikely to succeed. The existing sanctions, especially export controls, may contribute to a favourable military outcome for Ukraine by weakening Russia’s ability to resupply its forces, but whether they could be decisive in ending the whole war is up for debate.

Russia has almost inexhaustible natural resources, which form the foundation of its economy and function as a robust and vital stabilizing factor during hard times. Russia is the world’s second-largest producer of natural gas after the United States, the third largest producer of petroleum, and also one of the leading producers and exporters of diamonds, nickel and platinum.

The short-term financial impact of the sanctions on Russia’s economy has been substantial but appears to have dissipated since May. The Central Bank of Russia prioritized stabilizing the exchange rate after the first wave of sanctions, which included a freeze of roughly half of the central bank’s international reserves.

While the sanctions froze most of Russia’s overseas assets, Russia continues to receive revenues from its energy exports. The oil and gas payments mitigate Moscow’s need to source other domestic resources for revenue. Oil and gas revenues accounted for 47% of Russian federal revenues from January to May this year, even though Russia’s oil production fell in April. Oil and gas revenues, however, increased by 80%. Russia still earns roughly $1 billion per day in export revenues from oil and gas, about half of which flows directly into Moscow accounts. For comparison, Russian fiscal data suggests that Moscow spent $325 million per day on military expenditures in April, the latest data available.

While advanced economies in the West largely support the sanctions, some other economies do not fully comply with them, even if diplomatically condemning Russia’s invasion. However, there is little indication of sanctions violations, including from Chinese firms, as companies in third countries fear secondary sanctions.

- 2. IMPACT ON BUSINESSES, CUSTOMERS, AND GOVERNMENT SPENDING

The stable times are over. Since the very beginning of the ´90s, businesses, and vendors have been building transparent logistical chains and connections. At present, all these established patterns are irretrievably lost, and companies returned to the starting positions where they began after the fall of the USSR. They are forced to look for goods and devise new (often complicated) schemes how to bring them to the Russian market. Some experts even think the businesses are back to the ´70s or ´80s times.

Generally, the times when one country could provide for itself with all necessary goods are over, with few exceptions, and Russia does not fall within these exceptions. Like most other countries, it is quite closely integrated into internationaltechnology/logistic chains, which are now experiencing huge fallouts. Regarding basic goods like food, many products (of Western companies) are leaving the shelves for the foreseeable future, but new comparable products from domestic companies are taking their place. For example, the McDonald´s chain was sold to a Russian company, which in June on Russia day opened the former McDonald´s restaurants under a new name Vkusno & tochka, which translates “Tasty and that´s it”, and with the slogan “The name changes, love stays”. The economic results of the new chain could provide a test of how successfully Russia´s economy can become more self-sufficient and withstand Western sanctions.

State procurement of software and hardware in Russia collapsed by more than 30% in H1 2022 when the volume of announced IT procurements by state-owned companies collapsed by 46 billion rubles (approx. 771 million EUR) . In Russia there are two types of state-owned companies: in one type, the state is the 100% owner. It includes the whole bureaucratic/municipal/educational apparatus. The other type is state-owned companies, which the state controls in the sense of major influence through partial ownership

- 3. PRINTING MARKET STATS

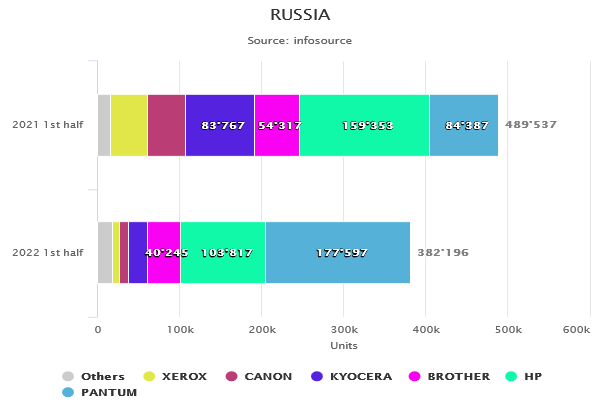

The formerly largest EEU market, the Russian market, contracted by 22% compared to H1 2021 and, in some categories, recorded unprecedented decreases, which led to its demise as the No. 1 market within the EEU area in the favor of Poland.

The total toner-based Copier/MFP Russian market (graph below) decreased by 22%, which at first glance does not look so bad. The personal Copier/MFP category registered a decline of 19%. BW personal Copier/MFP market was down 16%, representing a 98% share of the total personal category. During the same period, the personal color market decreased by 72%. In terms of brands, in the total personal Copier/MFP market the Chinese brand Pantum took the leading market position followed by HP and Brother.

On the other hand, the total office market sales were down 32% and represented only a 21% share of the total Copier/MFP market. The BW office Copier/MFPs represented an 87% share of the total office market, and its sales decreased 30%, while the color office market decreased 40%. Within the total office market, the number one was also Pantum, followed by the traditional leader Kyocera (whose sales declined 73% due to substantial transport problems), and the „newcomer“ Russian company F+ Imaging at third position.

The total toner-based single function page printer market (proportionally 48% of the total toner-based Copier/MFP market) registered a decrease of 18%, the BW SFP market decreased by 15% and represented a 97% share of the total SFP sales. The color SFP category registered a decrease of 58%. In term of brands, the SPF market copied the Copier/MFP market with Pantum at the top position, followed by HP and Brother.

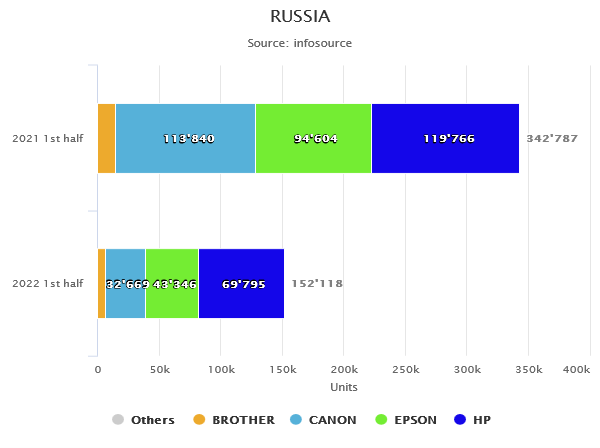

- The total inkjet market (graph below), proportionally about 27% of the size of the toner-based Copier/MFP market, took a heavy fall of 56%, driven by declines in both the consumer/home market (representing 85% of the total inkjet sales) by 54%, and the business market, which was down 62%. The popular category of ink tank/CISS devices went down 48% and represented a 72% share of the total inkjet market. The inkjet business CISS market was in H1 2022 dominated by Epson with a market share of 95%, and experienced a decrease of 58%. In terms of brands within the total inkjet market, there were registered traditional rankings, when Epson finished at first place in H1 2022, followed by Brother and Canon.

The total Large format printer in Russia was down 60% in H1 2022 compared to H1 2021. The Water-based ink type category (which represented 80% of the total market) declined at the rate of 54%, while the Solvent category went down 53%, the UV-LED cure category decreased 61%, and all the other LFP categories registered similar decrease rates.

Regarding the Document scanners, this market has decreased by 37% in H1 2022, despite a slight increase of No. 1 brand Avision (37% share of the market). However, all the other brands experienced decreases of around 50% of their sales volume in H1 2021. As for the Consumer scanners, this category declined 78%.

- 4. VENDORS BEHAVIOR, F+ IMAGING, PANTUM´S RISE

The vendors present in the Russian market are under intense political pressure and officially support the international sanctions against Russia; however, unofficially under this pressure, vendors adopt (business-wise) different market behaviour, which can be divided into several patterns.

One pattern is a strong position against any sales in Russia, demonstrated by office closures, shipments suspension, reduction of staff, and/or relocation of staff to other countries. In HP´s Moscow office most of the personnel received a notice to quit, and a very small part of employees was relocated to Almaty in Kazakhstan.

The departure of the major brands caused far-reaching implications to the market, the main one being the inability to fulfil valid contracts. For example, the withdrawal of HP from Russia did not allow one of its distributors, the company Smart Technologies, to supply hardware to the Russian Federal Tax Service under a 700 million rubles (approx. 11.7 EUR) contract. For this reason, the state contract was terminated in July by the customer unilaterally. Another example is the rise of lawsuits against foreign IT vendors, mainly for non-fulfilments of agreements.

The second pattern is a kind of ambivalent approach when business activities on the surface were suspended, but underneath the surface, the vendor is waiting to sell or provide devices under terms of previous contracts and agreements (the management of the European or Global HQ of the given vendor unofficially supports the sales and business activities in Russia. Also, local offices of some brands seek new ways to supply the equipment to Russia, for example, by reassigning the Russian territory under European HQ or Global HQ, in order to find effective possible ways to import goods via China or India.

The third pattern concerns Asian companies behaving normally, trying to sell as much as possible and get the most of the free market shares left by Western companies. This group of vendors consists of Chinese companies (Pantum, Huawei, Xiaomi, Avision – a Chinese brand based in Taiwan) and the South Korean company Sindoh. The company Sindoh is also a well-established OEM manufacturer as it manufactures devices for Konica Minolta, Lexmark, Ricoh, Pantum, and Katusha.

The fourth pattern concern Russian companies, which have at present a huge opportunity to fulfil the market demand that used to be covered by Western brands. For example, recently, the Russian company F-Plus Equipment & Development (the parent company of Marvel Distribution Group – the second largest IT distribution company in Russia), acquired the Russian business of printing equipment manufacturer Lexmark (which is owned by Chinese company Ninestar), combining it with its brand F+ imaging (OEM Lexmark), under which Russian printers and MFP and consumables are produced. Lexmark International Rus (LLC) will be renamed to F-Plus Imaging (LLC). F-Plus Imaging, LLC will continue to fulfil all current Lexmark contracts with Russian customers by providing alternative compatible solutions, as well as reassign the local sales managers and certified engineers who provide customer support. The F+ imaging brand will sell the same lines of printing equipment that were previously supplied by the vendor. Alexei Melnikov, the group’s managing partner and CEO of Marvel Distribution, noted that all big print and MFP vendors, such as HP, Xerox, Canon, etc., have left Russia, and they are selling off stock and are not making any expansion. According to Melnikov: “In the coming years, the printing market will be represented by an extremely limited number of players, including vendors of the Asian region. Our plan is to take an average of 20% of the market.”

Another essential feature of the present Russian printing market is the parallel import issue. In the current environment, when foreign market leaders have vacated the market, distributors want to find ways to supply the product. Russia`s government has allowed parallel imports, i.e., goods can be imported without the rights holder’s permission. However, this system does not work for the major international brands as it is simply impossible to find large volumes of devices elsewhere. In the case of small volumes, parallel imports can save the market.

One of the most interesting highlights of the Russian printing market in FY 2021 was the ascendancy of the Pantum brand, which continued at full speed also into H1 2022, helped by the sanctions against Western companies. In H1 2022 compared to H1 2021, Pantum managed to increase shipments in the total copier/MFP market from 84k to 178k units while HP in the second position recorded sales in the amount of 104k units and third Brother of 40k units. The massive push from Pantum for the dominancy on the Russian market will continue in H2 2022, as there is a rumour that it has placed a huge order for Sindoh to manufacture A3 devices. In this context, it is important to note that Pantum itself is an accomplished manufacturer and manufactures all of its own devices, so the order to Sindoh broadens the range of devices manufactured by Pantum. It looks like maybe the Russian market will be dominated by this Chinese brand.

The Chinese company Ninestar, founded in 2000, is, among others, the owner of Pantum (formally since 2020) and Lexmark (since 2016). Founded in 2010, Pantum is a Chinese printer manufacturer, offering rinters, printing materials, and printing solutions and services. In 2010 Pantum launched its first printer in the Great Hall of the People, a state building in Tiananmen Square in Beijing; the printer was promoted as the first “independent” Chinese printer. In 2011, Pantum began its overseas expansion with a current global footprint of dozens of countries.

- 5. CONSUMABLES AND SPARE PARTS MARKET

According to Infosource data, the installed base of combined MFP/SFP devices for toner and inkjet technology in Russia is approx. 11 million devices, and all these devices require consumables and spare parts. However, most vendors have withdrawn from the Russian market, simply ceasing to supply consumables and spare parts. Under these circumstances, the battle between genuine manufacturers of consumables and manufacturers of compatible consumables begins to intensify. It is clear that consumables for new promising market players will be at disposition in local warehouses in the nearest future. In the case of vendors that do not have a large market share, there is enough capacity for parallel imports in order to maintain the necessary stock of original consumables in the warehouses. For the former market leaders, who struggled to have as much of the original consumables as possible, these are challenging times ahead, because consumables and spare parts cannot officially be shipped to Russia. Parallel channels will not be able to cope with such supply volumes. The main role in the near future will be played by manufacturers of compatible consumables, which will be mainly from China. Although the market for original consumables will undoubtebly exist, it is likely to shrink and the price level for original spare parts and consumables will be high.

- 6. UNCERTAINTY AHEAD

Russia´s economy is undoubtedly staggering but still on its feet. However, reduced access to imported technologies, combined with the exodus of foreign firms and skilled Russian workers, will present without any doubt long-term complications for Russia’s economy. Economic sanctions are a political decision and maintaining the Western coalition in support of Ukraine will be essential.

An open question is how sanctions will if at all, contribute to an end to the conflict. Supporters of more sanctions, particularly on energy, believe fiscal and subsequent inflationary pressures might compel Russia to end the war. Critics note the poor historical track record for breaking the will of authoritarian regimes, especially during a war conflict. And as already mentioned above, Russia has at its disposal massive natural resources, which always sustained its economy ……..

- Petr Kramerius, Regional Manager

- [email protected]

- Boris Kuschev, Regional Manager

- [email protected]