COVID-19 accelerated digital transformation across every industry sector. New research shows that digital transformation and providing positive customer experiences are the top two priorities for banking in a pandemic-impacted world. The ‘Banking Transformed’ white paper from Jim Marous and OpenText™ looks at the opportunities and challenges of meeting consumer expectations as most engagement has moved from physical to digital channels.

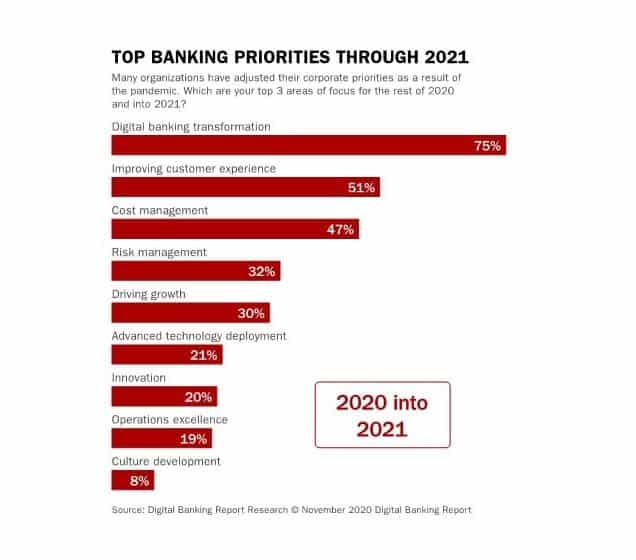

Over September and October 2020, global banks and credit unions were surveyed to discover their priorities as we emerge into a post-COVID world. Given the exploding need to deliver banking services digitally during the last several months, the focus on digital transformation and improving customer experiences could have been predicted (see Figure 1).

Consumers demand an omnichannel, personalized experience

More than ever, customers want ‘everywhere, anytime engagement’. They are increasingly looking for an experience that looks and feels the same regardless of how and when they engage with their bank. If a consumer banks on a device, a computer, a phone or in person at a branch, the experience should be consistent and contextual based on both the relationship established and the behaviors of the consumer over time.

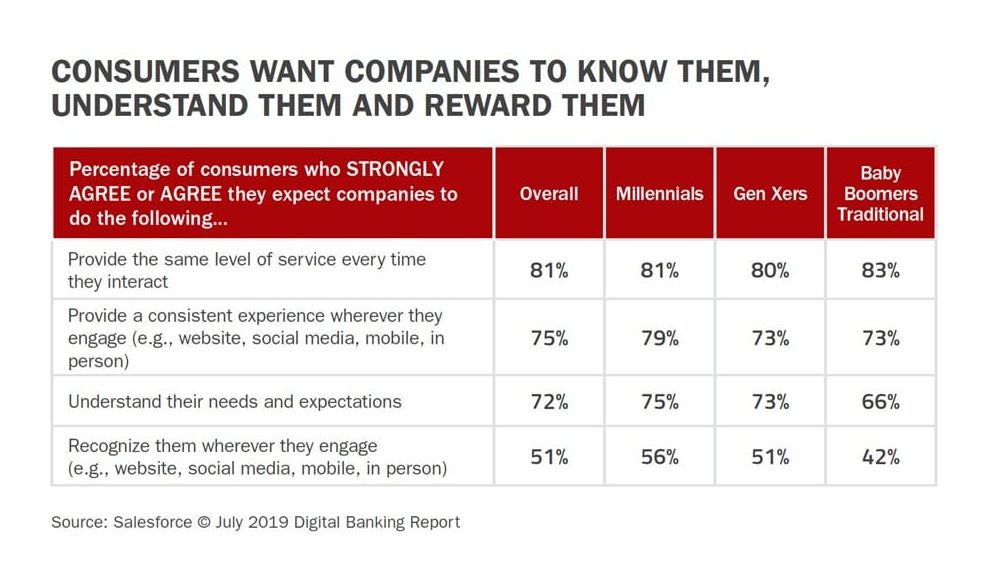

Research has found that all customers want companies to know them, understand them and reward them (see Figure 2). Key to this is delivering the same level of experience across channels – closely followed by personalization, based on your knowledge and understanding of their individual requirements.

According to Jim Marous, author of the report and co-publisher of the Financial Brand “Now more than ever, banks and credit unions need to reset their customer experience agenda to meet the needs of consumers who have adjusted their lives as a result of the pandemic. Not only have consumers moved in vast numbers, across all demographic segments, to digital channel use, but they expect organizations to leverage data and insights to provide better solutions that are personalized to their specific needs.”

In the coming year, banks and credit unions have to decide how best they can help customers beyond the new account opening process to include the entire customer journey. This includes personalized engagement and proactive financial advice similar to that delivered by digital leaders in other industries.

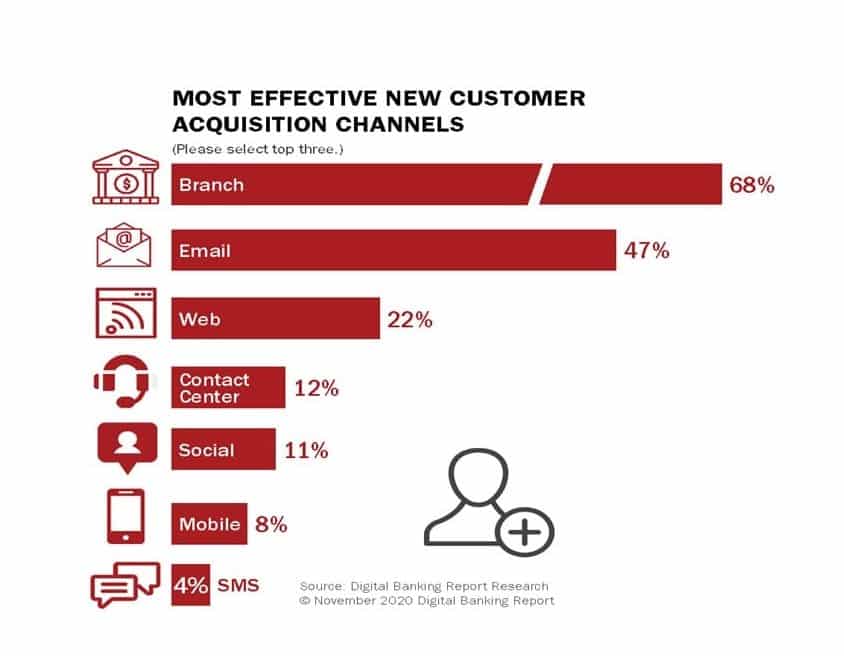

Omnichannel doesn’t just mean digital

While the pandemic accelerated a move to digital channels, it’s important that more traditional channels remain part of the mix. Customers like to do business with a person in branch and our research showed that the branch is still the primary source of new customer acquisition (see Figure 3). However, the primary reason for this was the inability of many banks and credit unions to support digital account opening or loan applications. In other words, rather than the ‘preferred channel’ for consumers, the branch is often the default channel due to lengthy digital processes. It’s expected consumers will demand improved digital banking options in the future.

“Technology will never completely replace people and brick and mortar — it will instead transform and reimagine the way that we use both resources. Banking involves the full overall experience, not just routine transactions,” comments Jim Marous. “As bank lobbies continue to reopen, fewer customers will visit physical facilities, but some will still look for advice, education, and the confidence and trust that human interaction can provide. We foresee an ongoing shift to digital as consumers demand digital experiences with less friction and better personalization.”

The need for an omnichannel experience platform

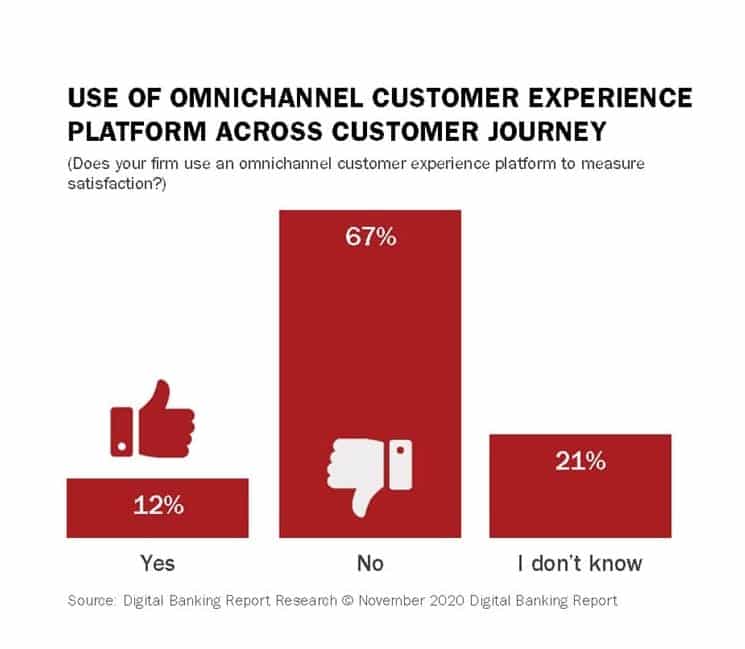

When we look at the ability of companies to deliver on the promise of personalized customer experience, a gap emerges. Today, only 12% of organizations say they have an ominchannel banking platform that allows them to manage and measure their performance across the customer journey (see Figure 4).

Here’s a sneak peek into predictions for 2021: there will be a growing adoption of digital experience platforms that can connect all the component parts of a customer experience technology ecosystem together.

Delivering the optimal customer experience is the key competitive edge of any institution. Customers today are expecting and demanding excellent, seamless, personalized service and experiences across their entire journeys from their bank or other financial services provider. A digital experience platform for retail banking allows the company to deliver the connected, contextual, hyper-personalized experience that customers wants and expects. It doesn’t have to be a large, daunting, undertaking. It is pieces of a puzzle that can be implemented in stages, with benefits achieved quickly.

Download your copy of the Banking Transformed white paper or watch the ‘Transforming Digital Customer Journeys’ webinar.