The last few years have been challenging for all countries and economies, with successive disruptive events (Covid lockdown, supply chain abnormalities, increased transportation and energy costs, etc.) impacting and distorting the natural performance and evolution of markets around the world. The Turkish economy has been one of those affected.

Nevertheless, despite the significant challenges faced, the Turkish economy has demonstrated resilience and continued to grow at a robust pace, primarily due to the lax monetary policy implemented by the government. However, this policy has also worsened some of the existing imbalances in the economy, resulting in a sharp depreciation of the exchange rate and a significantly high rate of inflation.

How is the Turkish Large Format Printing Market performing?

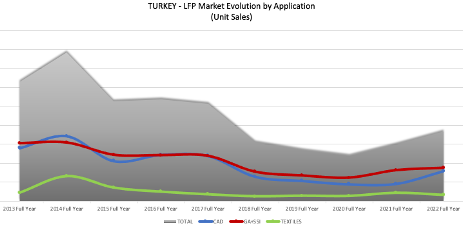

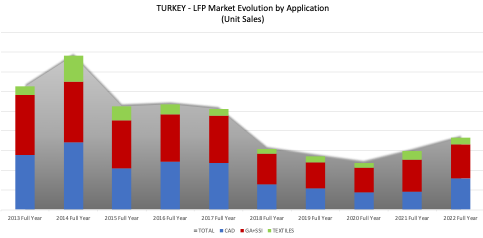

The above factors, indicate the high inflation rate and currency depreciation, that significantly impacted the Turkish LFP market due to its dependency on equipment imports. This situation led to a long-term decrease in total unit sales, with the market falling from nearly 4K units in 2014 to 1.4K units in 2019. Finally in 2020, the pandemic drove the market to its lowest, by delivering only 1.2K unit sales. However, due to the normalisation of the economy after Covid, the market started to show a clear and strong sign of recovery, with increased unit sales of +24.7% in 2021 and +22.5% in 2022.

As in any other country, the Turkish LFP market is comprised of several applications and ink technologies that must be analysed and discussed separately for a better understanding of the ongoing trends. Infosource categorises the LFP market into three main segments: CAD/Technical, Graphic and Textile. Below you can find in-depth details regarding the evolution, current situation and main trends detected for each one of them.

CAD/Technical Segment

Worldwide, the LFP CAD/Technical market is dominated by three international brands: HP, Canon, and Epson and Turkey is no exception. What is different in the case of Turkey, is the contribution of this segment to the total LFP unit sales. While for the whole EMEA region, the CAD sales contribution exceeded the 66% of total LFP unit sales in 2022, in Turkey, this segment only contributed 43.5% total unit sales. Indeed, as is clearly visible in the above graph, for the last five years the CAD market has been selling less units than the Graphic segment; something completely different to what can be observed in almost any other EMEA country. The reason for this situation, is due to the CAD segment being a pure import market, dominated by multinational companies and with no cheaper alternatives either from local producers or from Chinese manufacturers.

Indeed, the overall Turkish CAD market has followed a long-term downward trend, falling from 1.7K units in 2014 to 0.5K units in 2019 (the last pre-pandemic year) and 0.4K units in 2020. However, in 2021 and 2022, this segment has shown strong recovery signs, increasing unit sales by reaching 0.8K units by the end of 2022.

In terms of brands, HP continues to lead the market, but with a lower market share compared to pre-pandemic years, followed by Epson and Canon with almost equal market share. According to unit sales, HP has experienced a bigger decrease in sales in the last decade in comparison to Canon who have experienced a smoother downward trend. Regarding Epson, from 2021 onwards, the company was able to revert its long-term downtrend delivering its best sales figures by the end of 2022, with 200 units placed.

In the coming years, Infosource expects an increase in the CAD market. The earthquake in Feb 2023 might boost further sales, as the need in infrastructure is expected to be exceptionally high. However, the unfavourable economic situation of the country, especially after the earthquake, might restrict the much needed investments.

GRAPHIC Segment (Graphic Arts & Soft Signage)

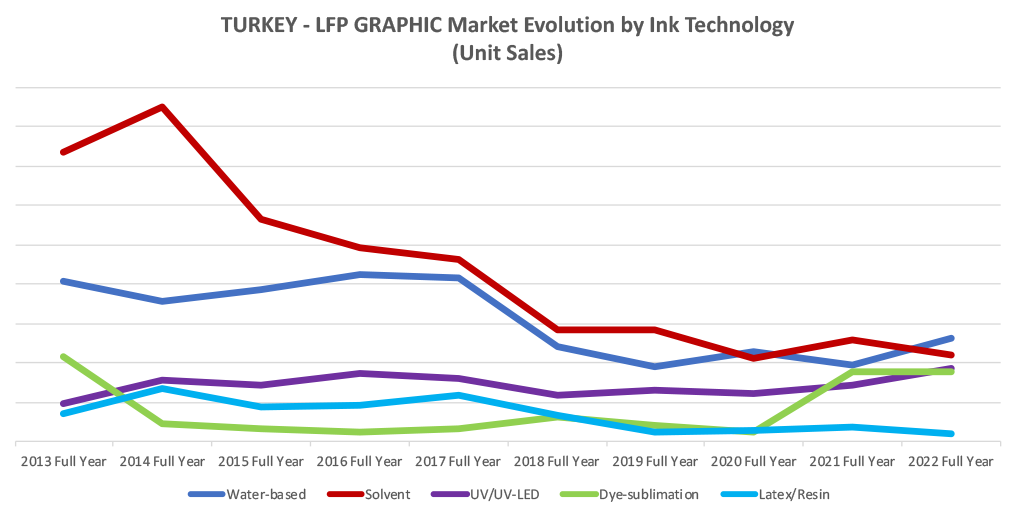

The Large Format Graphics market comprises the Graphic Arts and Soft Signage segments. This market includes digital roll-to-roll, flatbed, or hybrid inkjet printing devices that are designed to print on various types of media such as paper, vinyl, canvas, PVC, plastic boards, and textiles, mainly for advertising and signage purposes. The heterogeneity of this market also extends to ink technologies, with various types of inks such as WaterBased, Solvent, UV-Curing or Latex/Resin, competing in the field. This intrinsic heterogeneity favoured the appearance of a much bigger number of brands all over the world, created to satisfy the increasing demand of this type of digital devices. In the case of specially price sensitive markets, this phenomenon is even more intense. In the case of the Turkish market, we can see up to 30 different active brands having installations of large format graphic inkjet printers and this number increases year on year.

In this segment, it is quite interesting to analyse how the increasing import costs have pushed the appearance and development of local brands like Optimun Digital Planet, OEM assemblers like Trujet or local assembling facilities for Asian brands like Liyu.

Traditionally, the Graphic applications in Turkey contributed between 45%-50% of total LFP unit sales (48% in 2022) but, again, being an almost pure import business, the sales have fallen from 1.5k units in 2014 to 0.6k units in 2020. However, this market has also shown interesting recovery signs in the past two years, although at a lower rate compared to the CAD segment. By the end of 2022, almost 1K unit sales were accounted for.

In terms of ink technologies, as shown in the above graph, while Solvent, WaterBased, and Latex/Resin devices are immersed in a long-term downtrend, the UV-Curing systems (pushed by the UV-LED curing technology) are the ones showing a clear growth trend. This is a common trend observed in most developed countries as well as in emerging markets with rapidly increasing energy costs. The Dye-Sublimation devices oriented to soft-signage applications, have experienced impressive growth in the last two years, pushed mainly by Trujet installations.

For the upcoming years, Infosource expects this market to remain flat in 2023, with the market increasing from 2024, with a smooth growth trend until 2026, resulting in an approximate 2% CAGR over the forecasted period.

TEXTILE Segment (Industrial Textile Printing)

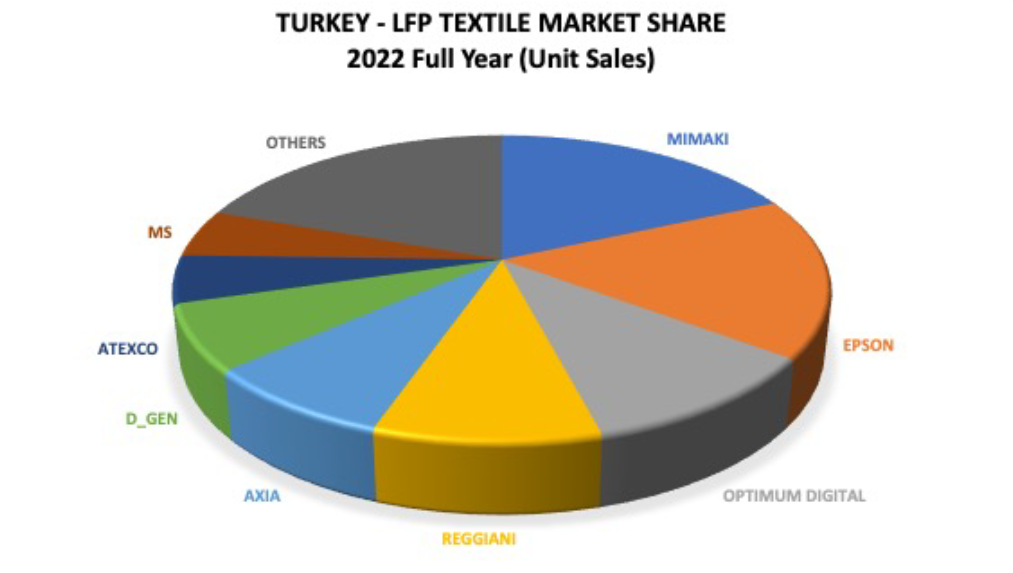

The Textile segment includes digital inkjet printing devices designed to print directly onto fabrics, mainly for industrial textile printing purposes for the fashion or home-textiles industries. Turkey is a so called “textile market”, with significant textile manufacturing industries producing on a large scale for the main international textile groups (Inditex, H&M, etc.). Consequently, the relative weight of textile applications is significantly higher, in Turkey, compared to other countries. In the last five years, the textile segment contributed almost 11% to the total LFP unit sales in Turkey alone, while the average for the whole EMEA region was only 2.4%.

In terms of brands, this market was traditionally dominated by Japanese manufacturers like Mimaki or Epson in the low-end and by European manufacturers like Reggiani, MS, Robustelli or Durst, in the high-end. Therefore, it has experienced the same difficulties caused from the increasing import costs discussed above, and thus has delivered a clear downtrend since 2014. Moreover, during those difficult years, in a similar way to what happened in the graphic segment, we witness the appearance of local brands as well as several Asian brands coming from China (Homer, Atexco, Flora), entering the market to compete against the traditional manufacturers.

However, despite the intense competition and wide offer available, In the last five years, the installations did not exceed 200 unit sales per year. Even despite the promising rebound observed in 2021, the unit sales dropped again in 2022, weighed by the decrease in the textile production orders coming from the main international textile groups.

For the upcoming years, an overall and progressive increase is expected for the digital textile production worldwide and it is foreseen that significant production volumes will be re-localised back from Asian countries. This trend should increase the sales dynamics in proximity textile countries like Turkey, with good production capacities and still reasonably low labor costs compared to the most developed Western countries. Considering all, and assuming no other disruptive event will appear in the near future, Infosource expects the Turkish textile market to deliver a smooth growth trend in the next years, resulting in a 6.5% CAGR by the end of 2026.

About Infosource

Infosource is a leading global analyst firm headquartered in Geneva, Switzerland. Its worldwide team of analysts covers the print, office automation, production, large format, wide format, digital colour press and scanner market, as well as the Intelligent Capture and IDP market. Infosource provides in-depth analysis and guidance involving hardware, software and solutions used to automate business processes involving unstructured and semi-structured business inputs. For hardware, Infosource provide data by carefully monitoring more than 7000 models in 12 industries, providing model-level data and assists clients in studying long-term market trends.

For more information visit www.info-source.com

About this article and access to Infosource’s database

This article is based on statistics extracted from Infosource’s database (isDB), available under scalable subscription to match your exact research needs.

For more information, please contact Infosource here

Authors:

Rodrigo López Parte, Regional Manager

Eirini Louizou, Senior Analyst, Industrial Printing